Are you confident that your Insurance page is optimised for Google’s rankings? If not, it’s time to learn how to improve and stand out in the hugely competitive market that is the insurance industry. According to Blue Corona, over 50% of insurance searches are performed on mobile devices. Effective SEO can help you tap into the internet’s potential.

Your page needs to cater to Google’s many guidelines and algorithm updates to stand out. No stress, this guide will help you tackle all the requirements .

This blog will firstly take you through why SEO is unique and important for insurance companies, sitting within the Your Money, Your Life industry. It will then discuss a point-by-point strategy for how to do insurance SEO, with a focus on E-E-A-T.

Why is SEO so important for Insurance Companies?

As we all know, the insurance industry is a large and competitive market, dominated by industry giants. According to ABI, the UK insurance market is the largest in Europe and the fourth largest in the world. This market is predominantly online, so that’s where your potential customers are too.

SEO, then, is the key to ramping up your website traffic and finding those golden new customers. Good SEO can increase your visibility, get you higher ranks and generate trust in your audience. How exactly can you get your website to the top of the search results, competing with formidable competitors of the likes of GoCompare? Keep reading for the specific SEO strategies that will unlock those top spots.

Why SEO is also unique for insurance (E-E-A-T)

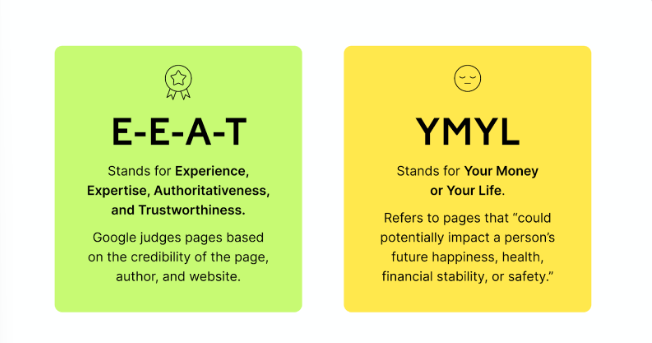

Insurance companies come under the YMYL (Your Money Your Life) category, so Google holds insurance websites to a higher standard. They need to focus on E-E-A-T more than your average, wholesome candle-making blog.

Source: Semrush

A ‘Your Money or Your Life’ page is a term used by Google for pages that they think could impact “the future happiness, health, financial stability, or safety of users”. Examples include medical advice, information on mortgages, news about ongoing violence and yes – insurance websites.

Google introduced its Search Quality Rating Guidelines for these pages in 2013. Then, in 2014, it added an emphasis on E-A-T, and last year, added an extra E. So in insurance SEO, we are now catering for E-E-A-T. But, what does this mysterious acronym actually mean for us?

E-E-A-T stands for:

Experience

Expertise

Authoritativeness

Trustworthiness

Google’s algorithms will analyse your insurance page with these factors in mind, when it is deciding where to rank you. Pages perceived to have a no or low E-E-A-T can be held back, and a high E-E-A-T website is rewarded. I’ll now run you through exactly how to optimise your SEO for each of these elements:

Experience

The newest element of the guidelines requires an insurance website to demonstrate first-hand experience in a subject. Content needs to prove that its insights are authentic. This is quite easy to adapt to – just make sure you’re getting your personal experiences and opinions in, or providing personal photos. Another way to optimise a website for the experience factor would be to include a good-quality About Us page.

Google explains this more in the guidelines, stating that they ‘consider the extent to which the content creator has the necessary first-hand or life experience for the topic. Many types of pages are trustworthy and achieve their purpose well when created by people with a wealth of personal experience.’

This is key because it differentiates between human and AI-written content. It also helps your brand image by showing the personality of the organisation, and proving that the employees are honest and authentic. This is important specifically in the insurance sector, where users are transferring money and need to feel safe.

Expertise

This element of the guidelines wants you to demonstrate that you’re a credible source and can be achieved in many ways. Expertise is best shown not told; you want to focus on demonstrating in-depth knowledge in your content. Do your research, and back up your opinions with other reliable sources.

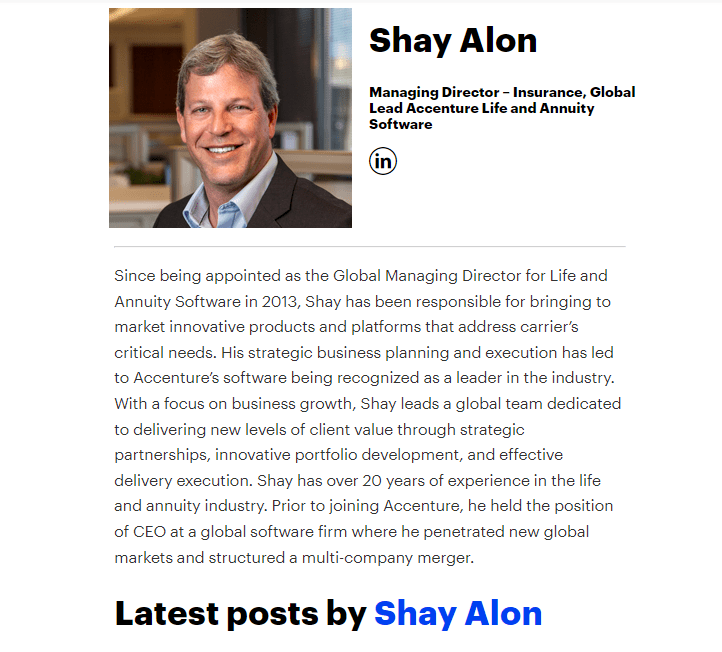

Another effective way to optimise SEO for the expertise guideline is by including writer profiles on your website. This should include formal qualifications and links to their other articles – all helping to demonstrate their skill set.

Here’s an example of an author bio on an Insurance Company’s website which is a gr-E-A-T example of Expertise:

Source: Accenture Insurance

This bio also includes an image of the author, and explanation of their role in the company; these are elements outlined in Google’s guidelines.

Authoritativeness

Author profiles, as well as creating a sense of expertise, will also build your authoritativeness. This refers to your reputation, especially within your sector. It can be developed through case studies which again show what you’re doing, rather than just claiming to it.

For example, CNN would be considered an authoritative source in the online News sector.

Authoritativeness can also be demonstrated through backlinks where other experts are citing you. These can be generated through infographics and content promotions, and are effective ranking signals for Google.

Trustworthiness

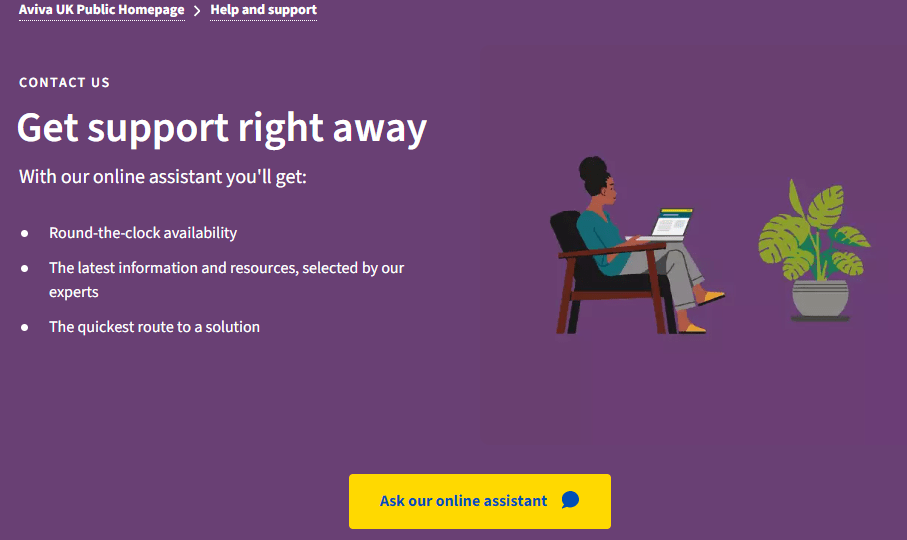

Lastly, Google’s guidelines for Your Money, Your Life pages specifies a need for trustworthiness. You can get this across via having a clear contact page, as well as reviews from real-life clients.

Have your customer service info displayed clearly, with accurate phone numbers.

Alongside this, demonstrating your expertise and authoritativeness will work together to show Google you’re a trustworthy site.

Source: Aviva Insurance

One last way that SEO differs in the insurance sector is that the sign-off time for content can take longer. This is because it will often have to go through stages of approval, as a result of the extensive YMYL guidelines. As an SEO content writer, you should bear this in mind when managing your strategy deadlines.

A strategy for SEO in the insurance sector

Speaking of strategies, I’m now going to take you through all the key steps to include in your plan for insurance SEO.

1. Do your keyword research

First and foremost, you guessed it – keywords. This is a critical initial stage to any effective insurance SEO strategy.

Examine the opportunity of keywords and phrases to what you’re targeting, determining which are most searched. Start by brainstorming keywords relevant to your demographic, and supplement this with use of tools like Keyword Planner and Ahrefs. These tools help you both with finding the words, and organising how you are going to map them.

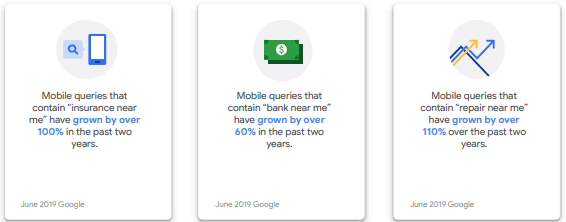

Another key aspect of keyword research is optimising it for local search. In their 2019 insights report, Google shared that customers are increasingly searching locally for their insurance. They reported that mobile queries that contain “insurance near me” have grown by over 100% in the past two years. I recommend optimising your website for local search through using geographically targeted keywords in the page’s content and URLs.

Remember to then prioritise working on getting those keywords in naturally – gone are the days of inorganic keyword-stuffing. Looking for a more detailed run-down of how to find and implement your keywords? Take a look at our blogpost giving you the complete keyword low-down.

Source: Google

Competitor analysis

As part of your keyword research, make sure you understand your competition. This is another great place to start with your SEO strategy as it helps you gain an initial grasp of where you’re sitting in the insurance market.

Tools like Moz and Semrush can be used to analyse your competitors’ website performance, in comparison to your online presence.

2. High-quality content is high-performing

Source: Allianz

It really is all you can E-E-A-T when it comes to insurance SEO. When it comes to writing content for YMYL pages, writing content that’s of good quality is crucial.

Here are some quick tips to achieve that illusive high-quality content:

- Never provide false information, remember Google loves a trusty source

- Keep your content up to date – you’re writing in a sector that changes frequently

- Proof, proof and proof again – expertise isn’t demonstrated through grammatical mistakes!

- Do your research. You want your content to have adequate depth

- Don’t forget the author bio and quotes from experts, for that good old authoritativeness

- Be descriptive but not flowery. Your writing needs to be clear.

3. Quantity *and* quality

Not only does content for insurance websites need to be high-quality, it is also beneficial to prioritise quantity.

BKA Content found that articles with more than 3,000 words receive an average of 77 percent more backlinks than shorter articles. This might be because good E-E-A-T content includes a certain level of depth and authority, which really needs at least 1,000 words to be achieved.

Also, a longer piece of content will allow you to get your keywords in more naturally, and thoroughly dissect your topic with multiple headings. Side note: this will help it appeal to Natural Language Processing algorithms!

4. Site structure makes all the difference

Source: Ripe Insurance

In your strategy for insurance SEO, it’s important to include a step dedicated to website structure. Carry out a site audit, checking for broken links and assessing your URL structures. Any broken elements will make for an unenjoyable user experience, and this won’t help your authoritativeness either.

On the other hand, a fully functioning site, with user-friendly design will reduce bounce rate and help the users to navigate through your pages. Also, search engines will find it easier to crawl your pages if the code and architecture is frequently reviewed.

Another top tip is that large images can affect your ranking. Keep them compressed so your website loads quickly. Google takes load speed into account when it chooses which pages to place on page 1. (You can also keep the loading time down by optimising your website’s code).

Have a look at this comprehensive guide for website structure if your pages are looking a little jumbled.

5. Prioritise reviews and a positive online reputation

Reviews are a fundamental part of insurance SEO. They help build up a good reputation, which you’ll remember was key for the T of E-E-A-T. Google specifically states in their guidelines that “for a YMYL website, a mixed reputation is cause for a Low rating.” This also refers to independent rating websites; prioritise obtaining good reviews both on and off your site.

Here’s an example of Ripe Insurance effectively using Trustpilot reviews on their landing page:

Source: Ripe Insurance

Through verified reviews, you will increase your website traffic, and boost your rankings. Reviews are also useful because they increase the amount of content on your page, and, as we know, Google loves quantity. What’s not to like?

Offline reputation is also important!

These online efforts at showing trustworthiness can be supported by Digital PR and outreach. Securing quality links will further ramp up your page traffic. So, make sure to devote time in your SEO strategy to both your online and offline reputation.

6. After implementing these steps … measure and analyse your own strategy

Utilise SEO analytics tools like Google Analytics and Google Search console to frequently assess which methods are improving your site’s performance. Keep tracking your rankings, your metrics like Salience, and which of your pages are most frequently visited.

Through keeping an eye on your analytics, you will then have a heads up on which tactics are getting your pages crawled, and what needs to be adjusted to optimise your rankings.

A final extra tip

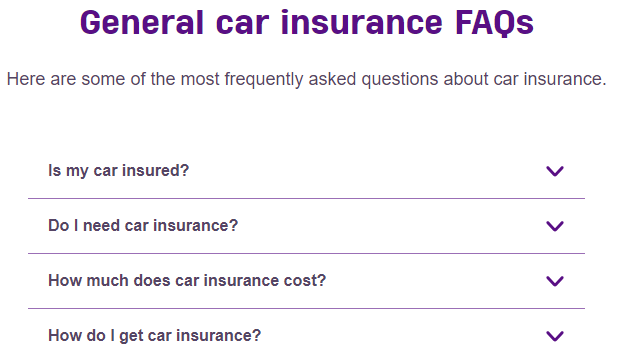

Having an FAQ page on your insurance website is a failsafe way to optimise your SEO. It shows Google that you are doubling down on satisfying user intent, and have a thorough understanding of your subject areas.

Source: MoneySuperMarket

To sum up

LSA found that for many insurance customers, search is their first step when assessing their options – 69% ran a search before scheduling an appointment. This blog has explained how and why SEO is specifically so important in the insurance sector. With the high level of competition, and YMYL category guidelines, developing a thorough SEO strategy is crucial to improve your rankings and traffic.

Hopefully, this guide will help you build a strong online presence to attract new customers. You’ll be insurance SEO-savvy in no time.